Monday, January 18, 2010

A Note about Bear Markets

A bear market is a market condition in which the prices of securities are falling, and widespread pessimism causes the negative sentiment to be self-sustaining. As investors anticipate losses in a bear market and selling continues, pessimism only grows. Although figures can vary, for many, a downturn of 20% or more in multiple broad market indexes, such as the Dow Jones Industrial Average (DJIA) or Standard & Poor's 500 Index (S&P 500), over at least a two-month period, is considered an entry into a bear market. - source Investopedia

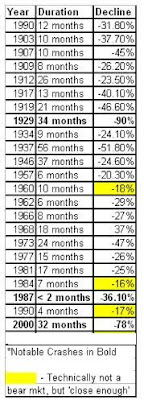

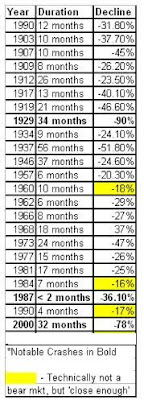

Here is a List of the largest bear markets of the last century:

Bear markets have always been temporary and thus can be viewed as "stock sales." The price of a stock is not a company's true value but only an approximation based on the supply and demand of the shares. There is no guarantee that these two ideas are always perfectly aligned. This disconnect from the fundamentals of a company can provide some of the best opportunities to invest. During the most recent bear market, stocks were priced for the apocalypse. As we now see the world did not end, and as a result you were rewarded handsomely for buying shares in between October 2008 and March 2009.

After making a closing high of 1561.80 on October 12, 2007 the S&P 500 entered a bear market that came to an abrupt end on March 9,2009 at 666.79. This was a drop of 57%, making it the third most severe bear market in 100 years. Stocks were on sale. Many companies were priced for bankruptcy including some of America's largest banks. Although the market has rallied all the way back to 1,136.03 from the bottom, a 70% gain from the March 2009 low, the S&P 500 is still 27% below it's October 2007 high. If you did not take advantage of absurd pricing of equities during the highest level of pessimism, you missed out on a huge opportunity to make some of your losses back. Just by purchasing an index fund that tracks the S&P 500 in March 2009, you would be up 70%. Some individual stocks have performed even better.

The 2007-2009 bear market was exacerbated by some modern day issues. The SEC eliminated the uptick rule on July 6, 2007. The uptick rule was implemented in 1938 and prevented short sellers from adding to the downward momentum when the price of an asset was already experiencing sharp declines. The rule required that every short sale transaction be entered at a price that is higher than the price of the previous trade. In March of 2009, following a conversation with SEC Chair Mary Schapiro, Rep. Barney Frank of the House Financial Services Committee said that the rule could be restored. To this day, the uptick rule has not been reinstated. On top of that, computerized trading had become a large part of the volume in the markets. The deadly combination of naked short selling and computerized trading lead to bear raids on stocks like Lehman Brothers, Bear Stearns, and many other companies. The SEC had also approved levered short selling ETFs that allowed investors to buy an instrument to short a sector or market, without the normal short selling margin requirements. The SKF, ProShares UltraShort Financials, was used by hedge funds as well as individuals to pile on the short selling of bankshares. In a world where the government had taken preferred equity stakes in banks, it was mind boggling that they would allow such instruments to exist. Alas, we were in the midst of a negative feedback loop that completely ignored the fundamentals of companies. Short selling fed off of the severely bearish technicals of the market and lead many stocks to their breaking points.

At the peak of the SKF at 268, market sentiment was at the lowest I had seen in my life. The fear was palpable, no one wanted to take risk. These are the moments in the stock market where it pays to be a contrarian, or in this case an optimist. I had one thesis that I held onto: there would be a financial system in the future. If I were to buy a basket of bankshares, the gains would outweigh their losses. I was luckier than I could have ever imagined as the banks left standing in March 2009 did survive and proceeded to give investors some of the best gains in the 2009 recovery. One of our main core beliefs is that it pays to have guts. Put differently by Warren Buffett, "Be Greedy when others are fearful. Be fearful when others are greedy." Although bear markets like the one of 2007-2009 are downright terrifying, times like these have historically been the greatest moments to invest.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment