Sunday, January 24, 2010

A Note about Support and Resistance

Modern economic theory is based on the idea that the market moves in a random walk. That is, the movement of the market and the stocks that comprise it cannot be predicted. In contrast, most experienced stock traders believe that the psychology of the market can be interpreted through its price action. One of our core beliefs is that close attention should be paid to technical trends. If a price movement has a certain sentiment behind it, there is a good chance that the stock will move in a predictable fashion. Technical analysts look for what they call "high probability" trades or outcomes. Who is one to believe: the efficient market economists, or the technical traders? The Federal Reserve Bank of New York weighed in on the matter:

"Technical analysis, the prediction of price movements based on past price movements, has been shown to generate statistically significant profits despite its incompatibility with most economists' notions of "efficient markets." Federal Reserve Bank of New York, C.L. Osler and P.H. Kevin Chang, Staff Report No. 4, August 1995.)

Support and Resistance are among the most basic forms of technical or chart analysis. I felt that this would be a good topic to cover today since support played an important role in the recent market downturn that happened last week. Many stocks that PMC tracks had long term support break down last Thursday or Friday. I'm going to focus on one of those stocks for this article.

This is a daily candlestick chart of Google Inc. from March 2009 until January 22, 2010. Please click on the image to see the entire chart.

This is called a candlestick chart. The red candles represent down days and the green candles represent up days. The bottom white line I have drawn represents where the support of the stock is. Support means that the stock is not likely to break below that area unless there is some change in sentiment. The support exists because there is sufficient buying demand at these levels to overcome selling pressure. The upper line represents where resistance is in the stock. This is where the stock is unlikely to break above unless there is some sort of change in people's opinion of the stock. This is the point where selling pressure overcomes the buyers of the stock. When the support and resistance are both trending upwards in this fashion, it is called an ascending channel. Each time the stock bounces off of the support or resistance traders notice, it reconfirms the support, and makes them all that much more difficult to break out of the next time.

You may ask, why does the stock haves support and resistance? Likely, some of it has to do with self-fulfilling prophecy. Humans are pattern recognition machines. When many people see the same pattern in the stock chart they may react in the same way. There are other reasons such as automated trading programs utilized at large institutions, people's propensity to focus on even numbers, or any other number of reasons. Ultimately, it doesn't really matter why it works just as long as it does.

As you can see in the above chart, Google stayed in its channel for nearly eleven months. There are a few different strategies that could have been successfully employed with Google over this time period. Since the channel was ascending, the most logical strategy would have been to purchase the stock in March or after the support had been confirmed and held onto it until the support level was broken on January 22nd.

So why after 11 months did Google drop below its support level (as shown in the circled portion of the chart)? On January 21, 2010, Google reported their quarterly results and the market reacted poorly to the news. The quarter's results changed the investors sentiments about the stock and thus there were no longer enough buyers at the support level to keep the stock elevated to that level. When a stock breaks below a major support level, often they fall to the next major support level. Major moving averages of a stock are often seen as support levels for stocks. The yellow line on the chart represents the stock's 100-day moving average. Once traders saw that Google had breached its previous support level, there was a high probability of the price falling to a major moving average. The 100-day happened to be the closest to the support level, and so one could have shorted the stock until the price reached the 100-day moving average and then covered their short with a relatively high probability of success. As you can see, Google closed almost exactly on the 100-day moving average.

Before investing in stocks, we recommend looking at both longer term and short term charts to determine where major support and resistance levels exist for a stock. Generally, it is not wise to buy a stock near its resistance level. On the other hand, buying near a major support level can give you some confidence that you bought the stock for a good price. However, nothing is certain. Many people bought Google on January 20th assuming that it would move back up after hitting its resistance level, but unluckily for them, this happened to be the time that the stock broke down below its support because of the change in the sentiment of the stock.

"Technical analysis, the prediction of price movements based on past price movements, has been shown to generate statistically significant profits despite its incompatibility with most economists' notions of "efficient markets." Federal Reserve Bank of New York, C.L. Osler and P.H. Kevin Chang, Staff Report No. 4, August 1995.)

Support and Resistance are among the most basic forms of technical or chart analysis. I felt that this would be a good topic to cover today since support played an important role in the recent market downturn that happened last week. Many stocks that PMC tracks had long term support break down last Thursday or Friday. I'm going to focus on one of those stocks for this article.

This is a daily candlestick chart of Google Inc. from March 2009 until January 22, 2010. Please click on the image to see the entire chart.

This is called a candlestick chart. The red candles represent down days and the green candles represent up days. The bottom white line I have drawn represents where the support of the stock is. Support means that the stock is not likely to break below that area unless there is some change in sentiment. The support exists because there is sufficient buying demand at these levels to overcome selling pressure. The upper line represents where resistance is in the stock. This is where the stock is unlikely to break above unless there is some sort of change in people's opinion of the stock. This is the point where selling pressure overcomes the buyers of the stock. When the support and resistance are both trending upwards in this fashion, it is called an ascending channel. Each time the stock bounces off of the support or resistance traders notice, it reconfirms the support, and makes them all that much more difficult to break out of the next time.

You may ask, why does the stock haves support and resistance? Likely, some of it has to do with self-fulfilling prophecy. Humans are pattern recognition machines. When many people see the same pattern in the stock chart they may react in the same way. There are other reasons such as automated trading programs utilized at large institutions, people's propensity to focus on even numbers, or any other number of reasons. Ultimately, it doesn't really matter why it works just as long as it does.

As you can see in the above chart, Google stayed in its channel for nearly eleven months. There are a few different strategies that could have been successfully employed with Google over this time period. Since the channel was ascending, the most logical strategy would have been to purchase the stock in March or after the support had been confirmed and held onto it until the support level was broken on January 22nd.

So why after 11 months did Google drop below its support level (as shown in the circled portion of the chart)? On January 21, 2010, Google reported their quarterly results and the market reacted poorly to the news. The quarter's results changed the investors sentiments about the stock and thus there were no longer enough buyers at the support level to keep the stock elevated to that level. When a stock breaks below a major support level, often they fall to the next major support level. Major moving averages of a stock are often seen as support levels for stocks. The yellow line on the chart represents the stock's 100-day moving average. Once traders saw that Google had breached its previous support level, there was a high probability of the price falling to a major moving average. The 100-day happened to be the closest to the support level, and so one could have shorted the stock until the price reached the 100-day moving average and then covered their short with a relatively high probability of success. As you can see, Google closed almost exactly on the 100-day moving average.

Before investing in stocks, we recommend looking at both longer term and short term charts to determine where major support and resistance levels exist for a stock. Generally, it is not wise to buy a stock near its resistance level. On the other hand, buying near a major support level can give you some confidence that you bought the stock for a good price. However, nothing is certain. Many people bought Google on January 20th assuming that it would move back up after hitting its resistance level, but unluckily for them, this happened to be the time that the stock broke down below its support because of the change in the sentiment of the stock.

Monday, January 18, 2010

A Note about Bear Markets

A bear market is a market condition in which the prices of securities are falling, and widespread pessimism causes the negative sentiment to be self-sustaining. As investors anticipate losses in a bear market and selling continues, pessimism only grows. Although figures can vary, for many, a downturn of 20% or more in multiple broad market indexes, such as the Dow Jones Industrial Average (DJIA) or Standard & Poor's 500 Index (S&P 500), over at least a two-month period, is considered an entry into a bear market. - source Investopedia

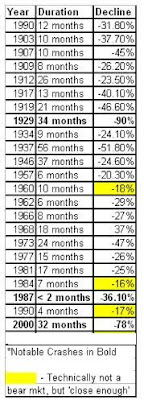

Here is a List of the largest bear markets of the last century:

Bear markets have always been temporary and thus can be viewed as "stock sales." The price of a stock is not a company's true value but only an approximation based on the supply and demand of the shares. There is no guarantee that these two ideas are always perfectly aligned. This disconnect from the fundamentals of a company can provide some of the best opportunities to invest. During the most recent bear market, stocks were priced for the apocalypse. As we now see the world did not end, and as a result you were rewarded handsomely for buying shares in between October 2008 and March 2009.

After making a closing high of 1561.80 on October 12, 2007 the S&P 500 entered a bear market that came to an abrupt end on March 9,2009 at 666.79. This was a drop of 57%, making it the third most severe bear market in 100 years. Stocks were on sale. Many companies were priced for bankruptcy including some of America's largest banks. Although the market has rallied all the way back to 1,136.03 from the bottom, a 70% gain from the March 2009 low, the S&P 500 is still 27% below it's October 2007 high. If you did not take advantage of absurd pricing of equities during the highest level of pessimism, you missed out on a huge opportunity to make some of your losses back. Just by purchasing an index fund that tracks the S&P 500 in March 2009, you would be up 70%. Some individual stocks have performed even better.

The 2007-2009 bear market was exacerbated by some modern day issues. The SEC eliminated the uptick rule on July 6, 2007. The uptick rule was implemented in 1938 and prevented short sellers from adding to the downward momentum when the price of an asset was already experiencing sharp declines. The rule required that every short sale transaction be entered at a price that is higher than the price of the previous trade. In March of 2009, following a conversation with SEC Chair Mary Schapiro, Rep. Barney Frank of the House Financial Services Committee said that the rule could be restored. To this day, the uptick rule has not been reinstated. On top of that, computerized trading had become a large part of the volume in the markets. The deadly combination of naked short selling and computerized trading lead to bear raids on stocks like Lehman Brothers, Bear Stearns, and many other companies. The SEC had also approved levered short selling ETFs that allowed investors to buy an instrument to short a sector or market, without the normal short selling margin requirements. The SKF, ProShares UltraShort Financials, was used by hedge funds as well as individuals to pile on the short selling of bankshares. In a world where the government had taken preferred equity stakes in banks, it was mind boggling that they would allow such instruments to exist. Alas, we were in the midst of a negative feedback loop that completely ignored the fundamentals of companies. Short selling fed off of the severely bearish technicals of the market and lead many stocks to their breaking points.

At the peak of the SKF at 268, market sentiment was at the lowest I had seen in my life. The fear was palpable, no one wanted to take risk. These are the moments in the stock market where it pays to be a contrarian, or in this case an optimist. I had one thesis that I held onto: there would be a financial system in the future. If I were to buy a basket of bankshares, the gains would outweigh their losses. I was luckier than I could have ever imagined as the banks left standing in March 2009 did survive and proceeded to give investors some of the best gains in the 2009 recovery. One of our main core beliefs is that it pays to have guts. Put differently by Warren Buffett, "Be Greedy when others are fearful. Be fearful when others are greedy." Although bear markets like the one of 2007-2009 are downright terrifying, times like these have historically been the greatest moments to invest.

Thursday, January 14, 2010

A Note about Price-to-Book Value

This is the first post in a recurring series in which we explain one of Panoptic Management Consultants, Inc.'s core investment beliefs or principles.

Since Benjamin Graham, the father of value investing and author of The Intelligent Investor, price-to-book has been considered an important benchmark in determining whether a stock is selling at a discount or a premium. Benjamin Graham was famously quoted as saying, "In the short run, the market is a voting machine, but in the long run it is a weighing machine." In other words, sometimes the market is not acting efficiently and does not accurately value equities, but over time the market will be able to reflect the true value of a company. The issue was, how does one know if the company is currently being "voted" on by the market, or being "weighed."

Graham came up with an ingeniously simple method of determining whether a stock was being sold at a discount or not. His rule of thumb was to only buy companies that were selling for 66% or less of their tangible book value. Book value is a company's net asset value and in theory is the amount of money received if a company liquidated all of its assets. Because Benjamin Graham was only buying companies worth 66% or less of their theoretical liquidation value, he thought this gave him something called a "margin of safety". He proposed that a margin of safety limited his downside and provided more opportunity for upside. His price-to-book rule made him an extraordinarily successful investor. If you need more proof of Graham's prowess, Warren Buffet has Benjamin Graham to thank for teaching him how to invest during business school at Wharton, and later hiring Buffet at his investment firm.

Today, it is no longer as simple as only purchasing stocks that are 66% of tangible book value. In fact, there are usually very few, if any, of those stocks around. However, that does not mean that book value is no longer an important indicator of when a stock is inexpensive. Multiple studies have been shown that stocks selling below their book value or at a relatively lower book value than the market have higher returns on average than the market as a whole. Two of those studies are,“Decile Portfolios of the New York Stock Exchange, 1967-1984,” by Roger Ibbotson, Finance Professor at Yale School of Management, and the 1992 study, “The Cross-Section of Expected Stock Returns” from Eugene Fama and Kenneth French, published by the Graduate School of Business, University of Chicago. After dividing up the NYSE into decile's based on stocks' price-to-book values, The Ibbotson study, found that between 1967 to 1984, the lowest price-to-book stocks had a compound annual rate of return of 14.36% while the stocks with the highest book value had a compound annual rate of return of 6.06%. Every subsequent decile with a higher price-to-book had a lower return than the lower price-to-book deciles before it (As a reminder, past results do not guarantee future performance). Fama and French's study concluded that after studying the relationship between stock performance and P/E, market cap, leverage, market beta, and price-to-book value, price-to-book value was consistently the most useful indicator at selecting outperforming stocks.

That is not to say that we recommend investors solely rely on book value to determine investments. A stock's book value may not always be accurate and can skew the calculation. A certain level of expertise may be required in order to better gauge the true value of a company's assets. As a final disclaimer, a 1997 study entitled, "New Evidence on Size and Price-to-Book Effects in Stock Returns", by Gerald R. Jensen, Robert R. Johnson and Jeffrey M. Mercer published by the CFA Institute, concludes that, "[s]pecifically, the small-firm and low price-to-book premiums are economically and statistically, significant, only in expansive monetary policy periods, and are small, and in some instances negative, in restrictive policy periods. This evidence suggests that investors should consider the Fed's policy stance when using strategies that rely on size or price-to-book ratio."

Low price-to-book can often be a powerful indicator in selecting stocks with better than average returns, but investors must make sure to perform their due diligence before investing. Using a low price-to-book measure as a screening method to narrow down potential investments can be a great first step in identifying companies you would like to own.

If all of this sounds confusing, or you do not have the time or inclination to invest for yourself, then we would recommend that readers consider investing in low fee index funds or having a professional investment advisor make investment selections for you. If you are interested in our services, you may contact us at panopticmc@gmail.com.

Since Benjamin Graham, the father of value investing and author of The Intelligent Investor, price-to-book has been considered an important benchmark in determining whether a stock is selling at a discount or a premium. Benjamin Graham was famously quoted as saying, "In the short run, the market is a voting machine, but in the long run it is a weighing machine." In other words, sometimes the market is not acting efficiently and does not accurately value equities, but over time the market will be able to reflect the true value of a company. The issue was, how does one know if the company is currently being "voted" on by the market, or being "weighed."

Graham came up with an ingeniously simple method of determining whether a stock was being sold at a discount or not. His rule of thumb was to only buy companies that were selling for 66% or less of their tangible book value. Book value is a company's net asset value and in theory is the amount of money received if a company liquidated all of its assets. Because Benjamin Graham was only buying companies worth 66% or less of their theoretical liquidation value, he thought this gave him something called a "margin of safety". He proposed that a margin of safety limited his downside and provided more opportunity for upside. His price-to-book rule made him an extraordinarily successful investor. If you need more proof of Graham's prowess, Warren Buffet has Benjamin Graham to thank for teaching him how to invest during business school at Wharton, and later hiring Buffet at his investment firm.

Today, it is no longer as simple as only purchasing stocks that are 66% of tangible book value. In fact, there are usually very few, if any, of those stocks around. However, that does not mean that book value is no longer an important indicator of when a stock is inexpensive. Multiple studies have been shown that stocks selling below their book value or at a relatively lower book value than the market have higher returns on average than the market as a whole. Two of those studies are,“Decile Portfolios of the New York Stock Exchange, 1967-1984,” by Roger Ibbotson, Finance Professor at Yale School of Management, and the 1992 study, “The Cross-Section of Expected Stock Returns” from Eugene Fama and Kenneth French, published by the Graduate School of Business, University of Chicago. After dividing up the NYSE into decile's based on stocks' price-to-book values, The Ibbotson study, found that between 1967 to 1984, the lowest price-to-book stocks had a compound annual rate of return of 14.36% while the stocks with the highest book value had a compound annual rate of return of 6.06%. Every subsequent decile with a higher price-to-book had a lower return than the lower price-to-book deciles before it (As a reminder, past results do not guarantee future performance). Fama and French's study concluded that after studying the relationship between stock performance and P/E, market cap, leverage, market beta, and price-to-book value, price-to-book value was consistently the most useful indicator at selecting outperforming stocks.

That is not to say that we recommend investors solely rely on book value to determine investments. A stock's book value may not always be accurate and can skew the calculation. A certain level of expertise may be required in order to better gauge the true value of a company's assets. As a final disclaimer, a 1997 study entitled, "New Evidence on Size and Price-to-Book Effects in Stock Returns", by Gerald R. Jensen, Robert R. Johnson and Jeffrey M. Mercer published by the CFA Institute, concludes that, "[s]pecifically, the small-firm and low price-to-book premiums are economically and statistically, significant, only in expansive monetary policy periods, and are small, and in some instances negative, in restrictive policy periods. This evidence suggests that investors should consider the Fed's policy stance when using strategies that rely on size or price-to-book ratio."

Low price-to-book can often be a powerful indicator in selecting stocks with better than average returns, but investors must make sure to perform their due diligence before investing. Using a low price-to-book measure as a screening method to narrow down potential investments can be a great first step in identifying companies you would like to own.

If all of this sounds confusing, or you do not have the time or inclination to invest for yourself, then we would recommend that readers consider investing in low fee index funds or having a professional investment advisor make investment selections for you. If you are interested in our services, you may contact us at panopticmc@gmail.com.

PMC 30 Spotlight - Helmerich & Payne Inc.

This is the first post in our series of the PMC 30 Spotlight, where we provide an in depth look at an individual stock and explain how it fits into our investment thesis. The PMC 30 can be seen on the right of the blog. Inclusion in the PMC 30 does not mean that we would buy the the stocks at their current valuations.

Helmerich & Payne, Inc. (HP) engages in the contract drilling of oil and gas wells in the United States and internationally. The company provides drilling rigs, equipment, personnel, and camps on a contract basis to explore for and develop oil and gas from onshore areas and from fixed platforms, tension-leg platforms, and spars in offshore areas. It conducts domestic land drilling primarily in Oklahoma, California, Texas, Wyoming, Colorado, Louisiana, Mississippi, Pennsylvania, Utah, Arkansas, New Mexico, and North Dakota; and offshore drilling in the Gulf of Mexico, offshore of California, Trinidad, and Equatorial Guinea. As of September 30, 2009, the company had 201 land drilling rigs in the United States; 9 offshore platform rigs; and international land rigs, including 1 in Venezuela, 6 in Colombia, 4 in Ecuador, 9 in Argentina, 1 in Tunisia, and 6 rigs in Mexico. In addition, Helmerich & Payne engages in the ownership, development, and operation of commercial real estate properties, as well as the research and development of rotary steerable technology. Its property portfolio includes a shopping center and multi-tenant industrial warehouse properties, as well as approximately 210 acres of undeveloped real estate land. The company was founded in 1920 and is based in Tulsa, Oklahoma. - source Yahoo Finance

"As we’ve gained market share, we have also maintained premium margins to our peer group, becoming the U.S. land drilling industry’s most profitable contractor during our fiscal year."

- President of the company, Hans Helmerich, from the company's 2009 Annual Report 10K

We at Panoptic Management Consultants, Inc. feel very strongly that energy is a major investing theme. As emerging market nations grow, their demand for energy will become even more insatiable. This was illustrated in the most recent super spike in commodities in 2008. Helmerich & Payne Inc. provides investors exposure to both the crude oil and natural gas exploration industries. Their FlexRig technology allows new areas to be tapped. As illustrated by Exxon Mobil's (XOM) bid for the natural gas company XTO Energy (XTO), and Total's (TOT) recent purchase of 25% of Chesapeake Energy Corp. (CHK) it is obvious that the larger integrated oil companies see value in natural gas shale plays. The United States has a tremendous amount of natural gas in areas that until recently we thought were tapped. The Barnett, Marcellus, and Haynesville shales could provide the nation with enough power to become energy independent. The FlexRig technology gives wildcatters (gas exploration companies) an innovative way to explore these shales. As we do not believe that current alternative energy is an adequate answer to the growing demand for energy, it is our opinion that natural gas will be an inevitable bridge fuel. Helmerich & Payne Inc. does move with the price of oil and gas, and will give investors who can't afford to trade oil and gas futures exposure to this investment theme. The correlation to the prices of oil and gas must be taken into consideration when deciding if and when you will invest in this company.

Helmerich & Payne, Inc. (HP) engages in the contract drilling of oil and gas wells in the United States and internationally. The company provides drilling rigs, equipment, personnel, and camps on a contract basis to explore for and develop oil and gas from onshore areas and from fixed platforms, tension-leg platforms, and spars in offshore areas. It conducts domestic land drilling primarily in Oklahoma, California, Texas, Wyoming, Colorado, Louisiana, Mississippi, Pennsylvania, Utah, Arkansas, New Mexico, and North Dakota; and offshore drilling in the Gulf of Mexico, offshore of California, Trinidad, and Equatorial Guinea. As of September 30, 2009, the company had 201 land drilling rigs in the United States; 9 offshore platform rigs; and international land rigs, including 1 in Venezuela, 6 in Colombia, 4 in Ecuador, 9 in Argentina, 1 in Tunisia, and 6 rigs in Mexico. In addition, Helmerich & Payne engages in the ownership, development, and operation of commercial real estate properties, as well as the research and development of rotary steerable technology. Its property portfolio includes a shopping center and multi-tenant industrial warehouse properties, as well as approximately 210 acres of undeveloped real estate land. The company was founded in 1920 and is based in Tulsa, Oklahoma. - source Yahoo Finance

"As we’ve gained market share, we have also maintained premium margins to our peer group, becoming the U.S. land drilling industry’s most profitable contractor during our fiscal year."

- President of the company, Hans Helmerich, from the company's 2009 Annual Report 10K

We at Panoptic Management Consultants, Inc. feel very strongly that energy is a major investing theme. As emerging market nations grow, their demand for energy will become even more insatiable. This was illustrated in the most recent super spike in commodities in 2008. Helmerich & Payne Inc. provides investors exposure to both the crude oil and natural gas exploration industries. Their FlexRig technology allows new areas to be tapped. As illustrated by Exxon Mobil's (XOM) bid for the natural gas company XTO Energy (XTO), and Total's (TOT) recent purchase of 25% of Chesapeake Energy Corp. (CHK) it is obvious that the larger integrated oil companies see value in natural gas shale plays. The United States has a tremendous amount of natural gas in areas that until recently we thought were tapped. The Barnett, Marcellus, and Haynesville shales could provide the nation with enough power to become energy independent. The FlexRig technology gives wildcatters (gas exploration companies) an innovative way to explore these shales. As we do not believe that current alternative energy is an adequate answer to the growing demand for energy, it is our opinion that natural gas will be an inevitable bridge fuel. Helmerich & Payne Inc. does move with the price of oil and gas, and will give investors who can't afford to trade oil and gas futures exposure to this investment theme. The correlation to the prices of oil and gas must be taken into consideration when deciding if and when you will invest in this company.

Full Disclosure:

Our CEO, Asif A. Khan, CPA (or his family members) is long Helmerich & Payne common stock.

The PMC 30

Introducing the PMC 30

We at Panoptic Management Consultants, Inc. have compiled a list of companies that we believe are important to watch. We do not necessarily believe that these stocks should be bought right now, but in aggregate, we believe they are a useful indicator of economic and market direction.

The PMC 30 appears on the right side of our blog. We will spotlight individual PMC 30 stocks throughout the year with blog posts. We will also keep you posted to any changes in the 30 stocks that comprise the PMC 30 via blog posts.

Full Disclosure

Our CEO, Asif A. Khan, CPA (or his family members) has positions in many of the PMC 30 stocks which are explained below:

AAPL, Apple Inc.

Long Common Stock

IBM, International Business Machines Corp.

Short Put Options*

HPQ, Hewlett-Packard Company

Long Common Stock

Short Put Options*

GOOG, Google Inc.

Long Common Stock

BAC, Bank of America Corporation

Long Common Stock

Long Call Options

Short Put Options*

JPM, JPMorgan Chase & Co.

Long Common Stock

GS, Goldman Sachs Group Inc.

Long Common Stock

Short Put Options*

C, Citigroup, Inc.

Long Common Stock

Short Put Options*

GILD, Gilead Sciences, Inc.

Long Common Stock

HP, Helmerich & Payne Inc.

Long Common Stock

RIG, Transocean Ltd.

Long Common Stock

FCX, Freeport-McMoRan Copper & Gold Inc.

Long Common Stock

CX, CEMEX, S.A.B. de C.V.

Short Put Options*

MON, Monsanto Co.

Long Common Stock

YUM, Yum! Brands, Inc.

Long Common Stock

GE, General Electric Co.

Long Common Stock

*Short Put Options explained:

Positions described as "Short Put Options" mean that Mr. Khan has a bullish opinion on the stock. By selling (shorting) a put option, one is creating an obligation to buy a stock at the strike price of the option. You are paid a premium for this obligation. For example if you sold a $30 strike price put option in a stock for a $10 premium, you would have an obligation to buy that stock if it dropped below $30 at expiration. Your effective basis in the stock would be $20. This is a strategy that Mr. Khan used at the height of volatility during the crisis. It is effectively a buy limit order but you are also paid a premium. This strategy will only be employed with high net worth clients that have marginable securities.

Our COO, Adam H. Kraus, JD, MBA has the following positions:

C, Citigroup, Inc.

Long Common Stock

Feel free to comment below...

We at Panoptic Management Consultants, Inc. have compiled a list of companies that we believe are important to watch. We do not necessarily believe that these stocks should be bought right now, but in aggregate, we believe they are a useful indicator of economic and market direction.

The PMC 30 appears on the right side of our blog. We will spotlight individual PMC 30 stocks throughout the year with blog posts. We will also keep you posted to any changes in the 30 stocks that comprise the PMC 30 via blog posts.

Full Disclosure

Our CEO, Asif A. Khan, CPA (or his family members) has positions in many of the PMC 30 stocks which are explained below:

AAPL, Apple Inc.

Long Common Stock

Short Put Options*

IBM, International Business Machines Corp.

Short Put Options*

HPQ, Hewlett-Packard Company

Long Common Stock

Short Put Options*

GOOG, Google Inc.

Long Common Stock

BAC, Bank of America Corporation

Long Common Stock

Long Call Options

Short Put Options*

JPM, JPMorgan Chase & Co.

Long Common Stock

GS, Goldman Sachs Group Inc.

Long Common Stock

Short Put Options*

C, Citigroup, Inc.

Long Common Stock

Short Put Options*

GILD, Gilead Sciences, Inc.

Long Common Stock

HP, Helmerich & Payne Inc.

Long Common Stock

RIG, Transocean Ltd.

Long Common Stock

FCX, Freeport-McMoRan Copper & Gold Inc.

Long Common Stock

CX, CEMEX, S.A.B. de C.V.

Short Put Options*

MON, Monsanto Co.

Long Common Stock

YUM, Yum! Brands, Inc.

Long Common Stock

GE, General Electric Co.

Long Common Stock

*Short Put Options explained:

Positions described as "Short Put Options" mean that Mr. Khan has a bullish opinion on the stock. By selling (shorting) a put option, one is creating an obligation to buy a stock at the strike price of the option. You are paid a premium for this obligation. For example if you sold a $30 strike price put option in a stock for a $10 premium, you would have an obligation to buy that stock if it dropped below $30 at expiration. Your effective basis in the stock would be $20. This is a strategy that Mr. Khan used at the height of volatility during the crisis. It is effectively a buy limit order but you are also paid a premium. This strategy will only be employed with high net worth clients that have marginable securities.

Our COO, Adam H. Kraus, JD, MBA has the following positions:

C, Citigroup, Inc.

Long Common Stock

Feel free to comment below...

Monday, January 11, 2010

Our Mission

We realize that in this difficult economic environment, and ever-changing financial services industry, an upstart investment advisor faces a number of challenges. The financial services industry has a crisis of trust. We plan to offer clients a high level of transparency and education to guide them through the troubled waters of the market. As a small firm, we will offer a client-focused service that allows for more time spent with the client than the standard larger firms. We will work, as a team, with the client to create a plan to reach their investment goals. We offer an incentive to small and young investors by providing free services on the first $10,000 under management.

Clients will have access to two types of research, fundamental and technical. The fundamental analysis research will include buy lists and sell lists of stocks updated weekly (monthly for less active investors, ie. mutual fund owners.) Fundamental analysis includes balance sheet, income statement and cash flow analysis. Quarterly and annual reports will be used, along with other analyst reports to create our recommendations. Technical analysis will be provided to aide clients with market timing. When the client asks for assistance with assessing a stock or fund, we will provide our fundamental opinion as well as the current technical analysis. As technical analysis changes day to day, we will not be basing buy and sell recommendations on them. We will use technical analysis to determine the best way to time a buy or a sell of a given security. Examples of key technical analysis data to be used in recommendations would be MACD, Moving Averages (200,50,20 day), market breadth, and average daily volume. This market has become more governed by technical analysis as some companies have stopped providing earnings guidance, but our advisory style will combine both types of stock and market analysis to give the best picture on which to base investment decisions.

Our clients will be offered a fresh look at investing. Our CEO may be younger than most large firm managers, but he did trade throughout the crash of 2008 (an experience no degree can give you) and has worked in private accounting as a CPA for 2 years. We do not believe in business as usual. We will act with an ethical obligation to our clients in providing advice. The client comes first for our company, and it is our hope that over time we will gain the trust that this industry needs to achieve a true recovery, for the economy and the portfolios of our clients.

We look forward to doing business with you,

Asif A. Khan, CPA

CEO

Panoptic Management Consultants, Inc.

Clients will have access to two types of research, fundamental and technical. The fundamental analysis research will include buy lists and sell lists of stocks updated weekly (monthly for less active investors, ie. mutual fund owners.) Fundamental analysis includes balance sheet, income statement and cash flow analysis. Quarterly and annual reports will be used, along with other analyst reports to create our recommendations. Technical analysis will be provided to aide clients with market timing. When the client asks for assistance with assessing a stock or fund, we will provide our fundamental opinion as well as the current technical analysis. As technical analysis changes day to day, we will not be basing buy and sell recommendations on them. We will use technical analysis to determine the best way to time a buy or a sell of a given security. Examples of key technical analysis data to be used in recommendations would be MACD, Moving Averages (200,50,20 day), market breadth, and average daily volume. This market has become more governed by technical analysis as some companies have stopped providing earnings guidance, but our advisory style will combine both types of stock and market analysis to give the best picture on which to base investment decisions.

Our clients will be offered a fresh look at investing. Our CEO may be younger than most large firm managers, but he did trade throughout the crash of 2008 (an experience no degree can give you) and has worked in private accounting as a CPA for 2 years. We do not believe in business as usual. We will act with an ethical obligation to our clients in providing advice. The client comes first for our company, and it is our hope that over time we will gain the trust that this industry needs to achieve a true recovery, for the economy and the portfolios of our clients.

We look forward to doing business with you,

Asif A. Khan, CPA

CEO

Panoptic Management Consultants, Inc.

Subscribe to:

Comments (Atom)