Saturday, March 9, 2013

Panoptic Management Consultants, Inc. is no longer a registered investment advisor

Greetings,

As of the beginning of 2013, Panoptic Management Consultants, Inc. is no longer a registered investment advisor.

We no longer are seeking clients.

We no longer provide investment advisory services.

Send any questions to panopticmc@gmail.com.

Thanks for your interest,

Asif A. Khan, CPA

CEO

Panoptic Management Consultants, Inc.

Wednesday, January 26, 2011

Game Trader: 2011 Stocks Outlook

2010 provided a great opportunity to invest in some gaming companies. We also saw the beginning of tectonic shifts in content delivery as emerging platforms along with mobile and social gaming came to the forefront as industry growth drivers. As 2011 kicks off, we would like to revisit our post-E3 stock ratings and add one more company to our coverage universe. We will also take a broader view of the U.S. equities market. Continue to read more at Industrygamers.com.

Saturday, November 20, 2010

A Note about Doji Candlesticks

I'm going to give a little presentation on doji candlesticks. A candlestick chart is a type of bar price chart that shows the open, close, high, and low for the over a specific period of time. The two charts I have below are a daily candlestick charts and a weekly candlestick chart, but you can use them for any time period you like. Candlestick charts were developed in Japan in the 1700's to chart and predict the movement of rice prices. Though the candlestick chart is extremely old, the analysis you use for them has remained much the same over the centuries. Today's stock traders are looking for the same patterns that people did before computers were involved. The reason that the analysis has remained mostly the same is because the psychology of markets has remained the same. Candlesticks give a person a window into the psychology of a stock over a specific period of time. The Japanese found that certain types of market psychologies lead to higher chances of specific outcomes and have honed the technique to make predictions.

Since there are far too many candlestick shapes and patterns to discuss in a short article, I will focus on what most traders would consider the most important. The doji can be considered to be the most important candlestick pattern because it works fairly well and it is extremely easy to spot. More traders pay attention to it because it is easy to see on a chart. This gives it the benefit of the potential of a self fulfilling prophecy. A doji represents an equilibrium in a stock. That means that the open and the close were the same or nearly the same. There are 4 different types of doji, but I don't want to get too into the woods in this article. I recommend the book Japanese Candlestick Charting Techniques, Second Edition written by Steve Nison if you want exhaustive coverage of doji and other candlesticks. I'd prefer to give an example and let you see how they can be powerful investing tools.

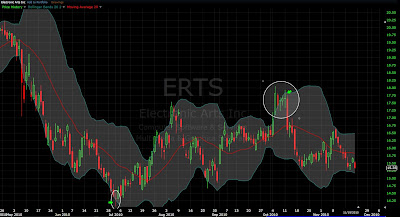

Here is a daily chart for the stock Electronic Arts (ERTS). This is a stock that some of our clients currently hold. I'd like to first point out the doji that occurs in early July 2010. I have it circled and arrowed on the chart above. This would be considered a long legged doji which means that the highs and lows for the day were fairly far off the open and the close. Doji are actually a fairly common occurrence and I don't want to mislead you into thinking that they are always important. Generally speaking, doji are only significant when they occur at the top or bottom of a trend. Here, there had been an extremely long down trend in ERTS. We then had a doji at the bottom of the Bollinger band. I consider this a strong buy signal in the stock. There was indecision at this point after the stock had taken a massive clobbering.

The second doji I want to focus on is the one that I have circled and arrowed in October. There are actually two doji in the circle. Here there was not really a trend and the doji just represented indecision. The fact that there were multiple doji in a row after a strong up move meant that stock was resting while trying to figure out what to do next. Here it meant bad things were going to happen.

Like I said previously, the nice thing about doji and candlesticks is that they work on any time frames. The chart below is showing the same period as the first chart. Notice how the following two weeks after there was a doji on the daily chart in July, there was also two doji on the weekly chart. This shows the indecision of the stock and can once again be viewed as a good entry point because there is a decent probability of the stock turning around from here. The double doji followed by a bullish engulfing candle in the circle shows that the stock has entered a new more bullish phase. Of course you would not want to make an investment solely based on the appearance of a particular candle pattern. Asif and I had been contemplating entering ERTS for a long time and felt that after viewing these candles play out that it was a good time to enter the stock.

I hope this article offered some kind new insight to your investing strategy. If you have any questions or feel that investing is better left to professionals, please feel free to contact us at panopticmc@gmail.com.

Monday, September 20, 2010

Game Trader: The Casual Gaming Arms Race

Here's a link to our latest article on Industry Gamers. It's about all of the recent acquisitions and activity around casual gaming companies. We hope you enjoy it.

Monday, July 26, 2010

Game Trader: A Detailed Look at Electronic Arts

Our latest article has been published at IndustryGamers.com. We give our in-depth analysis on EA (ERTS). Read it here.

Labels:

EA,

Electronic Arts,

ERTS,

Game Trader,

Industry Gamers

Wednesday, June 23, 2010

A Note about the Cumulative Volume Index (CVI)

The Cumulative Volume Index is one of my favorite market strength indicators. This momentum indicator works by subtracting all of the volume of the declining equities from all of the equities that are gaining. The resulting positive or negative number is then added to the previous results. This indicator is very useful in determining how much strength a bullish or bearish move has behind it.

In addition, if there is a divergence in the direction of the CVI in contrast to the S&P, it often serves as a warning sign that there will be a direction change in the market. If the CVI begins to trend down while the averages are moving upwards, it is a bearish sign. If it begins to trend up while the averages are moving downwards, it is a bullish sign.

In addition, if there is a divergence in the direction of the CVI in contrast to the S&P, it often serves as a warning sign that there will be a direction change in the market. If the CVI begins to trend down while the averages are moving upwards, it is a bearish sign. If it begins to trend up while the averages are moving downwards, it is a bullish sign.

I'd like to show how useful the CVI can be by giving three real examples of it predicting a change in market direction.

This first chart shows a weekly chart of the SPY ETF (basically the S&P 500) in yellow and the CVI in red and green. The time period that is important here is June 2007 to October 2007. You can see that the CVI made a high in June 2007 and then failed to meet that high again in October. In contrast, the S&P 500 made a new high in October. The divergence here was a strong indicator that something was wrong with the S&P's last rally. After that high, the S&P fairly rapidly fell from 1576.09 to 666.79.

This is a daily chart of the CVI versus the SPY in April 2010. If you remember, we had a pretty nasty 15% correction in April. Once again, the CVI was warning people that were looking for the signal. On April 26th the S&P hit a new recent high of 1219.80. However, the CVI failed to make a new high. What followed was a market correction down to about 1040; completing a 100% retracement of the previous market uptrend. Don't think however that all signals from the CVI will warn you of that big of a drop. When the divergence happens it can be for market adjustments of all sizes and it can also give you bullish signals.

Here is a daily chart for the relevant period from June 3rd to June 10th, 2010. Here the CVI made a new relative high on June 10th in comparison to June 3rd. In contrast, the S&P was lower on June 10th than it was on June 3rd. This was a bullish divergence signal. After this indicator made the signal the market moved from 1087.85 to 1131.23 (about a 4% upward move).

I hope these examples give you a good idea of how to spot divergence between the S&P 500 and the CVI. The signals don't always work, but they work often enough that if you combine them with some other indicators or fundamental data, you can have a leg up on the market.

Please remember to always do your own research before investing. If you would prefer for an investment advisor to handle your investments decisions please feel free to contact us as panopticmc@gmail.com.

Labels:

Cumulative Volume Index,

CVI,

SP 500

Gamer Trader: Rating the Stocks Post-E3

Asif and I just had a new article published on Industry Gamers. In the article we give our opinions on the publicly traded companies that were present at the show. You can check it out at www.industrygamers.com.

Labels:

Activision,

Apple,

GameStop,

Industry Gamers,

Microsoft,

Nintendo,

Sony,

Take-Two Interactive,

THQ

Subscribe to:

Comments (Atom)